last night, Wednesday May 28th, we finished our 5th and final Chicago area BUILT public event

below, an email i sent out to a friend a few days ago that gives a sense of what happened-

"Just wanted to share the news that Sojourn is having a

super-interesting experience in Chicago right now.

Much of the company has been in residence with me at Northwestern

University for a month, and before that, i'd been working for months

with community members and students

we're now thru 2 nights of a 5 night run, 3 events in evanston and 2 in

downtown chicago

20 performers, 60 person audiences, and i think we've

moved into an area of connecting experimental performance and civic

engagement, that is, at least for us, an interesting development...

we've developed a site -specific travelling game-based dramaturgy that

is half set performance, and half improvised and facilitated

interactivity, all deepening and complicating a conversation about city

growth, housing and urban change. We're staging it in a the bowells of

an old university building, and its main 2 level lecture hall, and

downtown in a beautiful old formal law forum. Within the structure,

each night's event has 3 different community 'experts', or coaches, who

spend a few minutes helping the audience consider the way they're

playing the game (a board game we play with them in three phases

scattered thruout the show), and these coaches complicate matters from

their own experience

last night, for instance, legendary public housing advocate Beauty

Turner, Evanston's Alderwoman of the first ward Cheryl Wollin,and

Chicago historian/author Bill Savage took on this function...they were

fantastic, and pushed us all in unexpected ways

the 75 minute event, which is a mix of scenes, movement, media and

public conversation, ends with the cast moving throughout the audience

with cellphones, asking the audence for their priorities for visioning

a city, and then the cast calls other cast members onstage, who tell

our designer, shannon scrofano, who draws by hand a map of chicago with

statements and questions from the audience that is projected live, and

immense, on a screen at the front of the room, as the live cellist

grows louder and louder

we have a full house coming tonight, and almost full next week in

chicago,

and so far, the audiences are an interesting mix of geographic, age and

cultural diversity partly due to, i think, the assignment my students have had

since march, which has been to build community partnerships/audience

constituencies...

just wanted to share, mid experience, because we're having a good (and

challenging) time and learning a ton.

And, it seems to be going well.

This project continues for us with 3 days of research and collaboration

with HartBeat Ensemble in Hartford, CT in June, and then we are home in

Portland from July on, working to create the premiere of what this

evolves into, hosted and commissioned by The AIR program at the South

waterfront and presented as part of this summer's TBA Festival. "

-----

I wrote that last Saturday.

We are learning so much, with and from the students here at Northwestern...and Chicago, with its scale, history and scores of amazingly active community members, is an incredible place to be thinking about city growth in these times...

More to come here soon.

From Hartford, and from Portland.

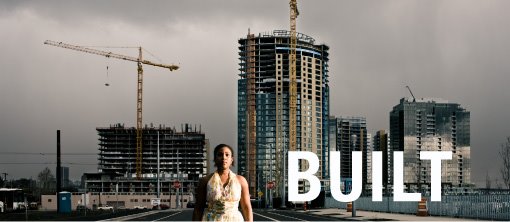

A Show / A Public Conversation / A Participatory Civic Planning Adventure

interesting links and articles

- Pica Blog Response to BUILT

- BUILT Review from The Oregonian

- Radio interview with Michael Rohd about BUILT

- Portland as a bubble? Article...

- BUILT PRODUCTION BLOG

- Brief cellphone video from our Hartford performance/civic event with Hartbeat Ensemble at City Hall in Hartford, CT on June 10, 2008

- Cabrini Green residents and the Chicago "Plan"

- Gentrification and "Upzoning" in the City

- Homelessness in Portland- Mercury Blog post, and comments

- List of dozens of recent articles that pertain to mixed-income housing, the Plan for Transformation, and the displacement that resulted from this plan

- LISTEN: public housing/gentrification panel

- michael rakowitz interview...

- NPR story on BUILT events in Hartford

- Portland SOWA Artist-In-Residence program

- TBA Festival in Portland

- urban to suburban migration- culture and tension

Subscribe to:

Post Comments (Atom)

1 comment:

This goes back to an earlier conversation about renting and home ownership and taboos, but it also seemed to touch on questions of how "to buy or not to buy" also hits on the question of where to live. From the NYTimes:

June 23, 2008

OP-ED COLUMNIST

Home Not-So-Sweet Home

By PAUL KRUGMAN

“Owning a home lies at the heart of the American dream.” So declared President Bush in 2002, introducing his “Homeownership Challenge” — a set of policy initiatives that were supposed to sharply increase homeownership, especially for minority groups.

Oops. While homeownership rose as the housing bubble inflated, temporarily giving Mr. Bush something to boast about, it plunged — especially for African-Americans — when the bubble popped. Today, the percentage of American families owning their own homes is no higher than it was six years ago, and it’s a good bet that by the time Mr. Bush leaves the White House homeownership will be lower than it was when he moved in.

But here’s a question rarely asked, at least in Washington: Why should ever-increasing homeownership be a policy goal? How many people should own homes, anyway?

Listening to politicians, you’d think that every family should own its home — in fact, that you’re not a real American unless you’re a homeowner. “If you own something,” Mr. Bush once declared, “you have a vital stake in the future of our country.” Presumably, then, citizens who live in rented housing, and therefore lack that “vital stake,” can’t be properly patriotic. Bring back property qualifications for voting!

Even Democrats seem to share the sense that Americans who don’t own houses are second-class citizens. Early last year, just as the mortgage meltdown was beginning, Austan Goolsbee, a University of Chicago economist who is one of Barack Obama’s top advisers, warned against a crackdown on subprime lending. “For be it ever so humble,” he wrote, “there really is no place like home, even if it does come with a balloon payment mortgage.”

And the belief that you’re nothing if you don’t own a home is reflected in U.S. policy. Because the I.R.S. lets you deduct mortgage interest from your taxable income but doesn’t let you deduct rent, the federal tax system provides an enormous subsidy to owner-occupied housing. On top of that, government-sponsored enterprises — Fannie Mae, Freddie Mac and the Federal Home Loan Banks — provide cheap financing for home buyers; investors who want to provide rental housing are on their own.

In effect, U.S. policy is based on the premise that everyone should be a homeowner. But here’s the thing: There are some real disadvantages to homeownership.

First of all, there’s the financial risk. Although it’s rarely put this way, borrowing to buy a home is like buying stocks on margin: if the market value of the house falls, the buyer can easily lose his or her entire stake.

This isn’t a hypothetical worry. From 2005 through 2007 alone — that is, at the peak of the housing bubble — more than 22 million Americans bought either new or existing houses. Now that the bubble has burst, many of those homebuyers have lost heavily on their investment. At this point there are probably around 10 million households with negative home equity — that is, with mortgages that exceed the value of their houses.

Owning a home also ties workers down. Even in the best of times, the costs and hassle of selling one home and buying another — one estimate put the average cost of a house move at more than $60,000 — tend to make workers reluctant to go where the jobs are.

And these are not the best of times. Right now, economic distress is concentrated in the states with the biggest housing busts: Florida and California have experienced much steeper rises in unemployment than the nation as a whole. Yet homeowners in these states are constrained from seeking opportunities elsewhere, because it’s very hard to sell their houses.

Finally, there’s the cost of commuting. Buying a home usually though not always means buying a single-family house in the suburbs, often a long way out, where land is cheap. In an age of $4 gas and concerns about climate change, that’s an increasingly problematic choice.

There are, of course, advantages to homeownership — and yes, my wife and I do own our home. But homeownership isn’t for everyone. In fact, given the way U.S. policy favors owning over renting, you can make a good case that America already has too many homeowners.

O.K., I know how some people will respond: anyone who questions the ideal of homeownership must want the population “confined to Soviet-style concrete-block high-rises” (as a Bloomberg columnist recently put it). Um, no. All I’m suggesting is that we drop the obsession with ownership, and try to level the playing field that, at the moment, is hugely tilted against renting.

And while we’re at it, let’s try to open our minds to the possibility that those who choose to rent rather than buy can still share in the American dream — and still have a stake in the nation’s future.

Post a Comment